Helping seniors achieve a peaceful retirement

Do YOu Know?

Ageing property and accrued interest have an impact on the actual value of a property

People often think that if the price of their property has increased from the price they purchased it, they have made some profit.

This is a common misunderstanding due to people being oblivious of the other factors such as lease decay, accrued interest, ageing property and others.

Inflated current property prices does not necessarily equate to healthy profit to a home owner.

Real life case study

Learn how these seniors did their property planning right

Age

60s

Previous Home

Private Property

After Restructure

5 Room HDB

Details of the individuals in the video before and after portfolio restructuring :

Senior Couple - Age 60s

From: Landed Property To. EA HDB

Senior Lady - Age 60s

From: EA HDB To: 3 room HDB

Below are some details of the individuals in the video.

Age

1. Senior Couple 60s // 2. Senior Lady 60s

Previous Home

1. Landed // 2. EA HDB

After Restructure

1. EA HDB // 2. 3 room HDB

04.

Integrity

Pharetra adipiscing rutrum et imperdiet sapien, semper blandit vulputate morbi bibendum leo et leo in praesent.

05.

Excellence

Adipiscing quis quis rhoncus etiam lobortis feugiat massa augue aliquam, dictum nulla suspendisse congue tincidunt lectus.

06.

Commitment

Morbi habitasse est vitae mauris sit sit luctus vestibulum lorem tincidunt eu leo nulla pellentesque enim.

Age

1. Couple 60s // 2. Senior Lady 60s

Previous Home

1. Landed // 2. EA HDB

After Restructure

1. EA HDB // 2. 3 room HDB

retirement planning: Property

Property As Part Of Retirement Planning

Here are some suggestions:

Sell & downgrade at retirement

Sell home at retirement, move into a smaller one, and then use remaining sale proceeds for retirement

Cash-flow positive properties

Rental income to pay recurring costs (e.g., property tax, maintenance fees) while still generating excess cash on top of it

Partial rental

Renting property and getting properties with dual-key layouts or moving in with children

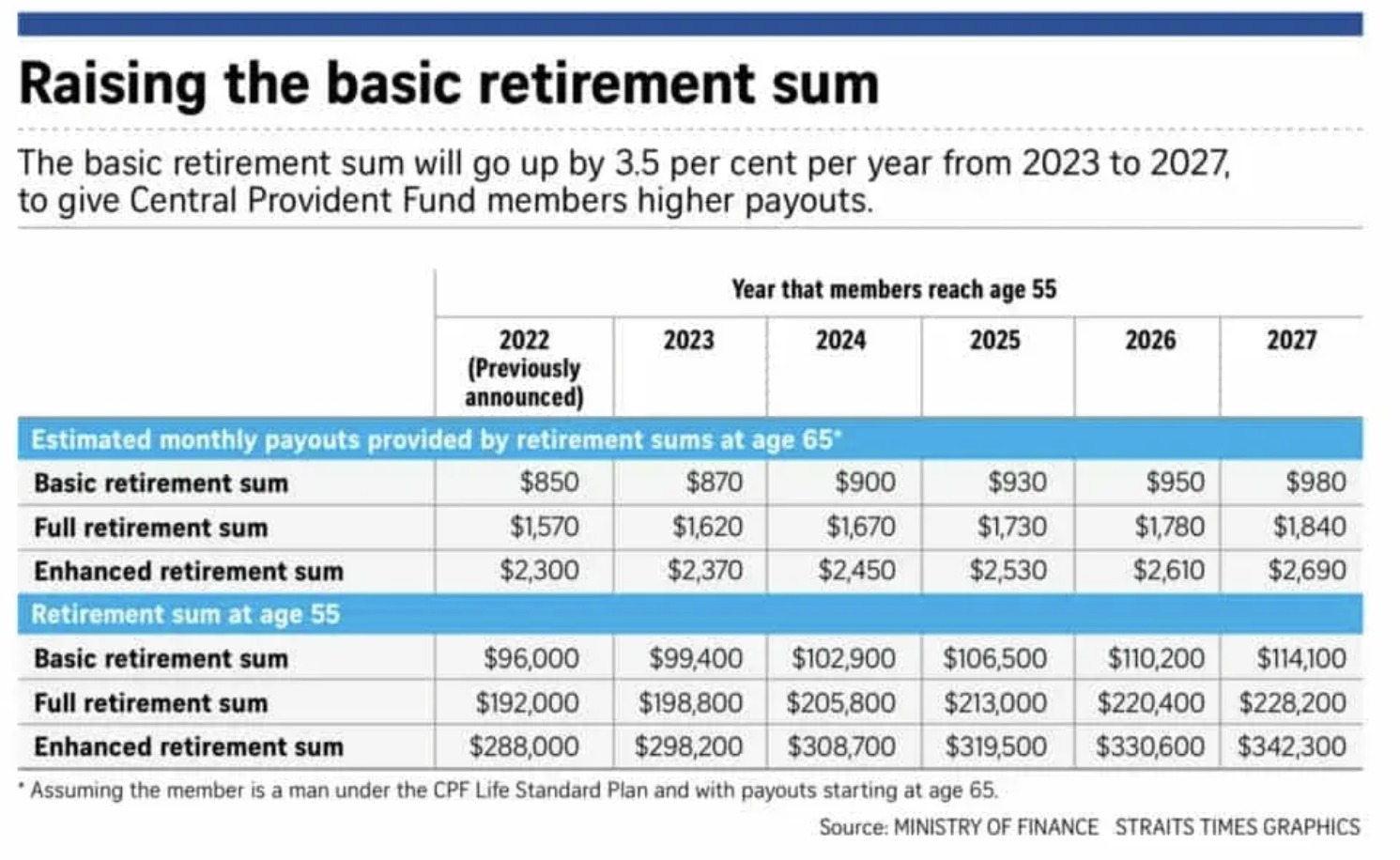

Pledging property for CPF

Pledged amount to be refunded into CPF from sale proceeds

Lease Buyback Scheme (for HDB properties)

Sell back a portion of your unused lease to HDB

food for thought

Are you worried about how your retirement years would be? Are you also worried for your ageing parents?

Your smart property planning plays a crucial part.

If you understand by now that it is important to plan your property portfolio but have not done so, I look forward to helping you materialise it.

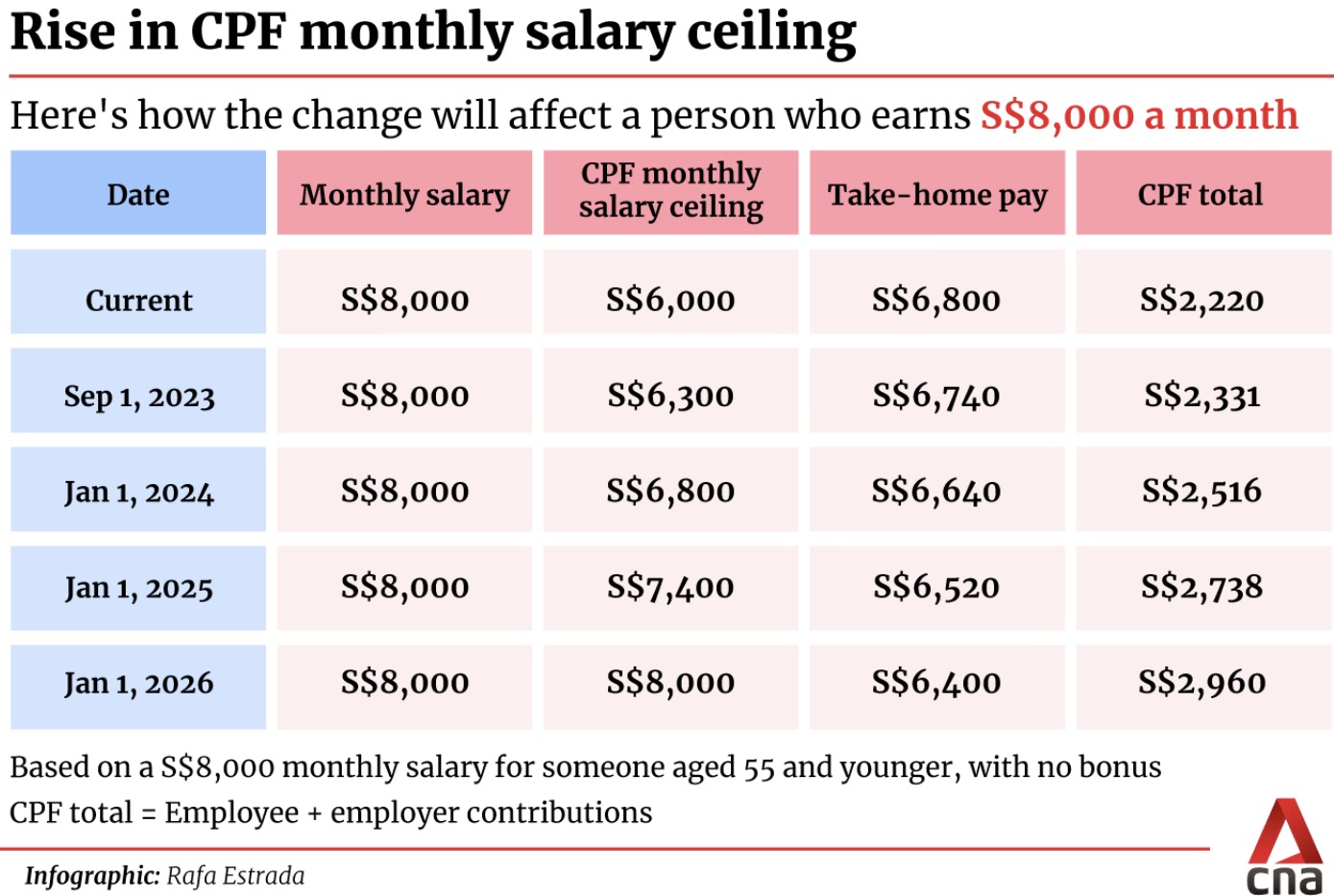

And if you (or someone you know) are reaching 55 and your retirement years, I would like to help you realise some things you may not be aware of.

affiliation